When you think of health insurance, what comes to mind? It’s complicated. It’s difficult to understand. Insurers and insurance brokers can’t be trusted. There’s a lack of transparency about my plan. It sounds like a financial black hole. At One World Cover, we hear these complaints all the time. Our consultants have over 15 years of experience handling health insurance for companies and some of the largest international schools in the region.

In this article, we have highlighted the 5 common myths of group health insurance plans and show you how you can overcome every one of these myths to reduce premiums, plan ahead, and increase employee satisfaction without enhancing benefits.

We’ll provide you with advice and information on how you can break the cycle of year-on-year health insurance premium increases and put you in the driving seat for the first time ever when it comes to managing your company’s group health insurance.

Myth number 1 – It’s better to wait until the last month of your policy to finalise your renewal pricing

Insurers are often vague when it comes to providing information and data about your plan, and can also be ambiguous when it comes to the methodology that they use to price your plan. This is no accident. Insurers are very careful to try and ensure that they remain in a position of control when it comes to your group health insurance plan.

How many times have you been told that your insurer cannot accurately price your renewal until the last month or two prior to the renewal date? While there is some truth in this if you’ve recently changed insurance providers, if you have been with the same provider for a number of years then the insurer is able to calculate your renewal at any time during the policy year. There’s no reason therefore for you not to be able to do the same.

The key number that insurers will look at when pricing the renewal of a large group plan (those with more than 100 employees) is the claims loss ratio. This is the percentage of total claims versus total premium. Insurance companies will typically look at the last 12 months claims on a rolling basis, regardless of how far into the policy year you might be. Of course it’s reasonable to expect a claims lag time of 2-3 months because hospitals can be slow to submit claims but once you have factored in reasonable lag time, you will then be in a position to review your claims loss ratio at any time, not just towards the end of the policy year.

With our key accounts, we help track their claims on a monthly basis and consequently, our clients are in a position to request and/or predict their renewal pricing at any time during the year. Our clients have this information at their fingertips anytime they want it. If you are not receiving the claims data from your insurer or broker on a monthly basis then you should make this a requirement going forward.

Myth number 2 – Your insurance premiums will go up every year

With the right information and planning, you can get your health insurance plan into a position where you can expect year-on-year decreases to the premiums.

There are two parts to this. The first part is to ensure – as you saw with myth number 1 – that you are getting the right information from your insurer. The second part is to ensure that you put in place a 1, 3 and 5 year strategy based on what that data tells you.

Some of the key things to look for include whether you have under-utilized benefits. If so, you might consider self-insuring those benefits or removing them from the plan altogether. How many people on your plan are having an annual health check-up? Remember that prevention is better than cure and is much more cost-effective in the long-term. And not only will this increase your staff morale but can help you protect your staff from critical illnesses. Have you done a recent review of your plan’s deductible? If your plan has no deductible, or a low deductible of only US$100, then you might consider increasing the deductible – even a deductible of US$200-300 will be considered by staff to be very reasonable, and will reduce premiums.

Where are your staff going for treatment? If they’re always going to the most expensive clinics and hospitals in your area what can you do to change how they use the plan? You might consider closer partnerships with medical facilities that are not part of your insurer’s high-cost provider list and bring into your workplace doctors from more reasonably-priced facilities for onsite services.

The key here is to first ensure that you are getting the right data from your insurer and then, with the help of your insurer or broker, to put in place a 1, 3 and 5 year strategy for plan design adjustments based on what that data tells you. With the right combination of year-on-year plan adjustments, you should start to see a shift in employee claiming practices, and premium savings after just one year.

Myth number 3 – You can only increase staff satisfaction with their health insurance by enhancing benefits

As we’ve just seen, part of the planning for ensuring year-on-year decreases to your group medical insurance premiums includes making plan adjustments. You’re probably thinking that decreasing your staff’s benefits is the fastest way to ensure that you’ll have a line of disgruntled employees lining up outside your office each morning with a pitchfork – doesn’t sound like much fun.

While any plan design changes need to be handled carefully, with well-planned and early communication with staff regarding the changes, it is our experience that it is possible not only to decrease benefits gradually over the short- to long-term but also to increase staff satisfaction in the plan at the same time.

As part of the communication to staff about why plan design changes are taking place, it’s important to highlight that small plan adjustments are necessary to ensure that as an employer you are able to keep intact the parts of the plan that staff value most in the long-term. These include emergency benefits, hospitalization and cancer treatment.

If you are making plan adjustments that might result in slightly decreased benefits for your staff, there are a number of things you can do that will have a really positive impact on your staff’s lives, such as implementing wellness initiatives or challenges. This can include working in partnership with your insurer or broker to help your staff and their families understand better how to use their plan, bringing GPs or physiotherapists onsite to see your members, or hosting health check-ups onsite at your school or office. A comprehensive annual health check-up serves as a great early warning mechanism against illnesses and can help find problems before they start, when the costs and chances for treatment and cure are better.

What’s fantastic about each of these initiatives is that they can often be done free-of-charge without an additional fee and are not part of your insurance premiums. It’s a win-win situation – the company saves money and your staff are happier.

Myth number 4 – You can’t control your health insurance premiums, making it impossible to budget

You’re probably starting to see now how increased transparency on your plan’s claims data, when combined with long-term planning, and wellness and healthcare initiatives outside your normal insurance benefits, puts you in a much stronger position when it comes to managing your health insurance premiums.

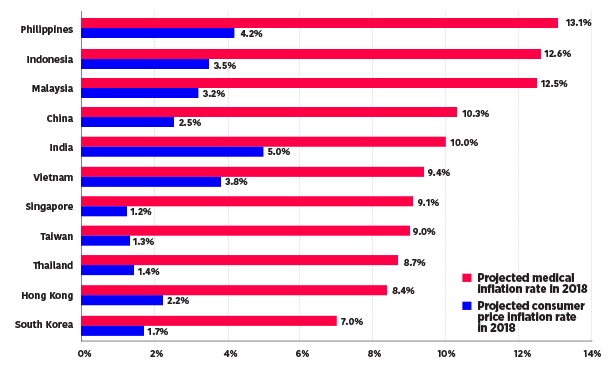

As you can see from this graph, medical inflation in most markets in Asia is generally between 7% and 14%. If you do nothing with your insurance plan – no plan adjustments that might impact how your staff use the plan, have no onsite wellness initiatives, or you do nothing to help your staff live healthier lifestyles then you should correspondingly expect to budget year-on-year increases of between 7 and 14%.

Of course, we know such year-on-year increases are simply not sustainable. Being in a strong position means being able to budget, where low single-digit increases become the worst-case scenario.

Even if your plan should experience a catastrophic claim such as cancer cases or a serious accident or long-term illness, your insurer will recognize the long-term planning you have done to keep your claims down. Your insurer will approach your renewal from a position of a partner and therefore not propose a huge spike in premiums, which would mean you having to switch providers. We know this to be true because we have experienced such situations with our clients and despite a few high-cost claims over the past few years, we have still seen a general trend of their insurance premiums coming down. Your insurance and your insurance budget will no longer be a black hole.

Myth number 5 – Your insurance spend is an expense rather than an investment

We are aware that your health insurance spend can be a significant line item on your company’s P&L. This makes it even more crazy that so many companies lack transparency and data regarding how their plan is running and so find it difficult to manage and budget for this expense.

With the right tools and long-term planning, we hope you will start to see how your company’s insurance spend will no longer be an expense that you cannot control and instead will become an investment in the long-term health and wellbeing of your staff. You will see an increase in workplace wellness, your staff will better understand their insurance cover and how to use it, and all of this will become a key driver of employee retention, happiness and wellbeing.

Need help with your company health insurance or concerned you are overpaying?

One World Cover is an Asia-based insurance consulting company and broker. We consistently help our clients reduce their group health insurance premiums by between 15-30%, without having to make any plan design changes or change insurance provider. Our many international school clients have done this using our proprietary digital Claims Data Analysis Platform (or “Control Room”) which gives our client’s finance team and senior management complete transparency to expose and significantly reduce any excess costs charged by your insurer or current broker. Get in touch: [email protected]