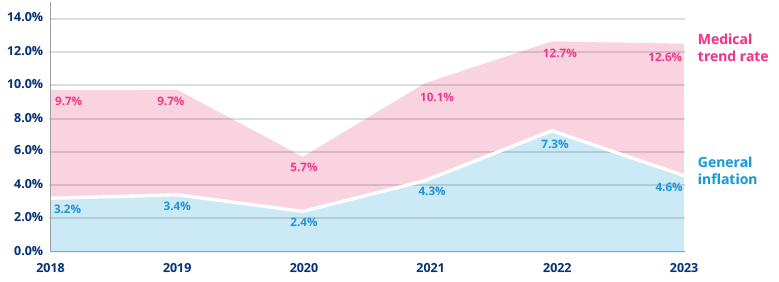

As medical inflation continues to rise, it’s inevitable that health insurance costs will increase as well. For CFOs and HRDs, this presents a difficult decision: absorb the costs or pass them on to employees. But with employees already feeling the financial squeeze, passing on more costs is easier said than done. And yet, without action, year-on-year increases of 10-15% will be unsustainable. So what can be done? Our experts suggest now is the time to implement a strategic 3-year plan and take advantage of key trends in health insurance. In this article, we’ll explore three key recommendations to help schools stay ahead of medical inflation and achieve sustainable renewals.

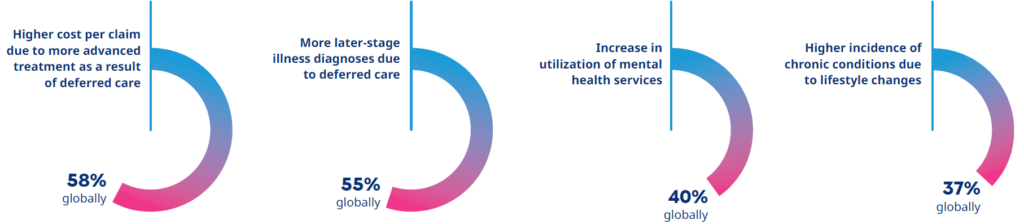

At One World Cover, part of our key purpose is to help our clients achieve predictable and sustainable renewals for their health insurance. Rampant inflation and increased healthcare utilization coming out of the pandemic are contributing to the highest projected increase in global medical costs in nearly 15 years. We are also seeing a COVID-19 hangover that is contributing to health insurance utilization increases in 2023, as care and treatment deferred during the pandemic returns.

Medical inflation trend:

COVID-19 hangover:

Your health insurance is therefore predictably going to increase at a higher rate over the next 2-3 years than we have seen in the past 10 years. Whether you are a CFO or HRD, you face the choice of bearing these increased costs or, as is more likely, passing more costs onto employees. That’s easier said than done though – in a recent discussion with a leading international school with 250 employees we were told an increase in the deductible of just US$150 would result in “an uprising”. One thing we have learnt in the past few years when speaking with CFOs at international schools is they would rather find additional budget for the health insurance than make plan design changes and face a mutiny by the faculty. But obviously that is not sustainable. Schools can’t have year-on-year increases of 10-15%.

That is why now more than ever is the time to plan to make changes through a strategic 3 year plan and to take advantage of some of the recent key trends in health insurance. If you start planning now, it’s still possible to stay ahead of the medical inflation trend, and get back to sustainable pricing.

Our 3 key recommendations to help you stay ahead of medical inflation and get back to sustainable renewals:

1) Start the process of implementing plan design changes now – build a 3 year strategy with a timeline of changes, bring together the health insurance committee now (with representatives from HR, finance and the faculty), start the communication around changes as soon as you can (and definitely before the summer break).

Important note: Creating a reliable 3 year budget forecast on your health insurance investment / budget is difficult. Your insurer will not do this for your organization, nor will most brokers – they simply are not invested to do so. As a CFO, if you want to ensure there is a 3 year strategic plan that aligns the 3 year forecast health insurance investment / budget, with your organization’s overall 3 year forecast budget you’ll need to create this strategy yourself, or work with a team that can do it for you. If you are not sure how to find alignment, get in touch with us, we’ll show you how.

2) Review your latest claims utilization data – make decisions in terms of plan design changes and potential workplace wellness programs based on what the data is telling you.

3) Ask your HR team to start building a workplace wellness strategy – start with your data. What are the main health issues at your school? Can you leverage the telehealth resources your insurer already has? An easy win is to start planning now for a mini health-check up onsite, which critically should be free-of-charge for your employees.

What if you don’t know how to implement a 3 year health insurance strategy, don’t get your claims utilization data or don’t know where to start in terms of arranging a mini health-check up onsite? Then get in touch with us. We have helped 100 of international schools over the past 15 years build world-class employee benefits programs, with predictable and sustainable renewals, delivered with empathy, warmth and care. We would love to bring these same values to your school’s health insurance plan.

Further reading:

One World Cover | Health Insurance Specialists If you are concerned that your current health insurance plan might not be sufficient for your needs at this uncertain time and are interested in us reviewing (free-of-charge, no obligation) your insurance cover to ensure you are fully protected – or can be better protected in the future – please get in touch. We are happy to help. In the meantime, stay healthy.