Making Sense of Your Health Insurance Claims Data

- Unlocking the Power in Your Health Insurance Plan’s Claims Data

- Understand Your Plan’s Loss Ratio…

- Do It Monthly and Save Year-on-Year

- More Tips on How to Unlock the Power of Your Health Insurance Plan’s Claims Data

- Stay in the Know on Where They Go

- Sort for Solutions

- Timing is Everything

- The Power is At Your Fingertips

- Stay in Control of Your Renewal

- Some Final Nuggets of Gold from Your Health Insurance Plan’s Claims Data

- Looking Backward for Insight to Plan Forward

- Making Sense of the “Per Cents”

- How the Numbers Add Up for You

Unlocking the Power in Your Health Insurance Plan’s Claims Data

Health insurance companies employ actuaries to pore over data to spot trends and predict the likelihood of future outcomes based on past events. With the right guidance and tools, the same power of information can be yours as a health insurance customer. Here’s how a little understanding can deliver a lot of insight into how you can keep health insurance costs down and make sure you never overpay again.

It starts with the goldmine of information in your health insurance policy’s claims data. While you can’t guarantee timely access to your data, this article will show you how understanding and using your data is a route to self-empowerment and getting the best possible health insurance coverage at the lowest possible cost.

Understand Your Plan’s Loss Ratio…

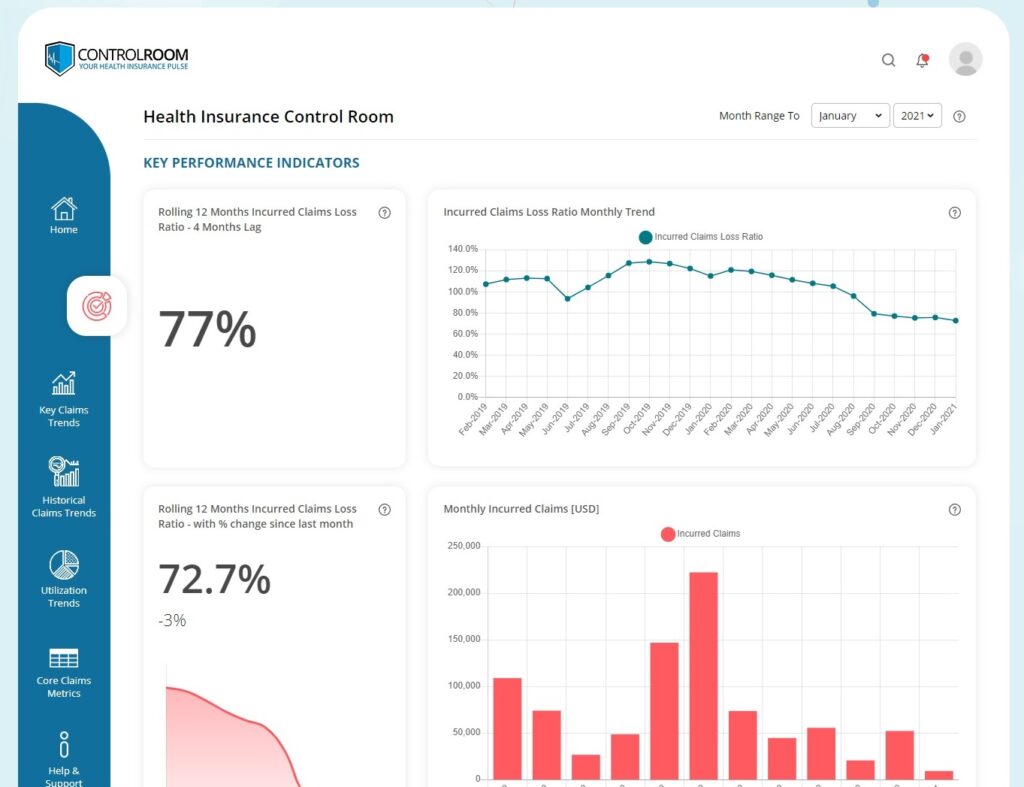

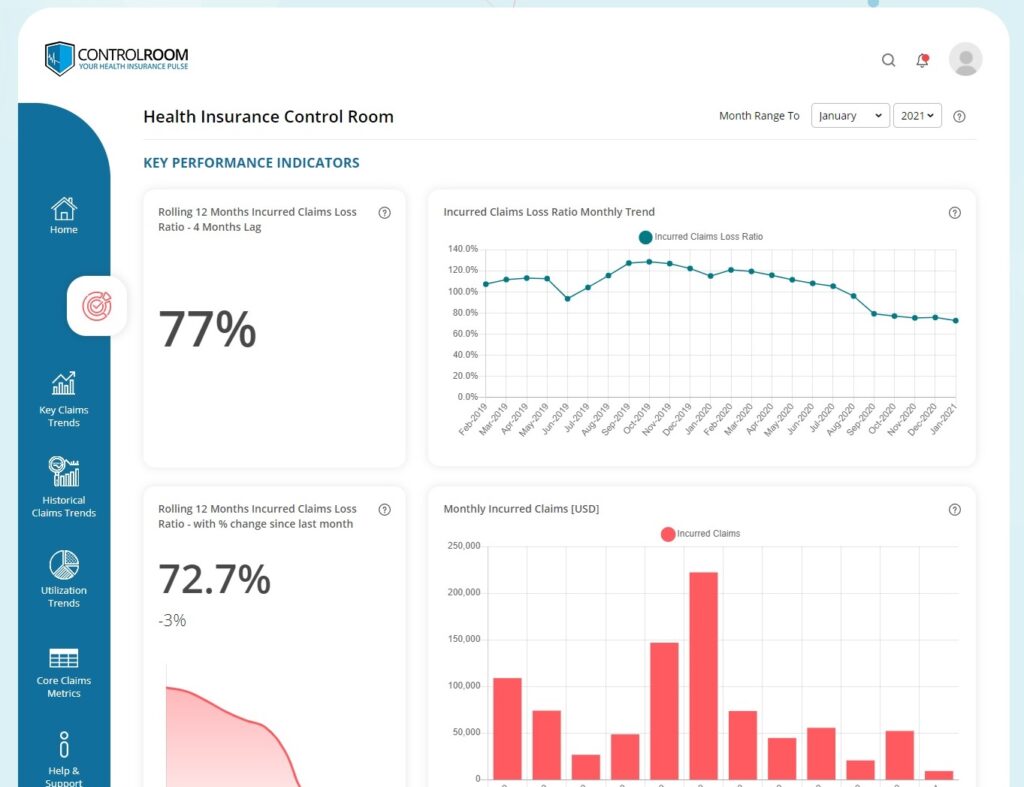

Add up all the health insurance premiums you pay during a policy year, and do the same with all the claims. The ratio of those two numbers is your loss ratio, and knowing how to interpret it can help you emerge as a winner. The loss ratio is the key number your insurance company is looking at when determining your renewal pricing.

An insurance company strives to make fair profit, with the administration costs accounting for between 15-25% of the total premiums you pay. If your loss ratio is higher than 70% you can expect a health insurance premium increase at renewal time. If the loss ratio is substantially lower you can expect your rate to stay the same or maybe even decrease.

…But Include Some Lag Time

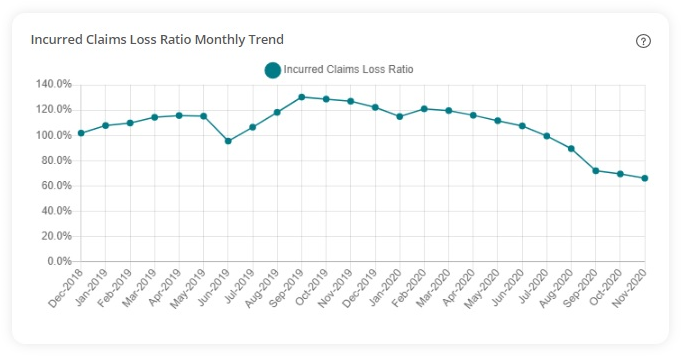

Every health insurance claim can be tracked using two key dates: incurred date (the month that treatment was actually received) and paid date (the month when the claim is paid by the insurance company). While there are certainly exceptions, generally speaking 90%+ are paid within 4 months of the treatment date.

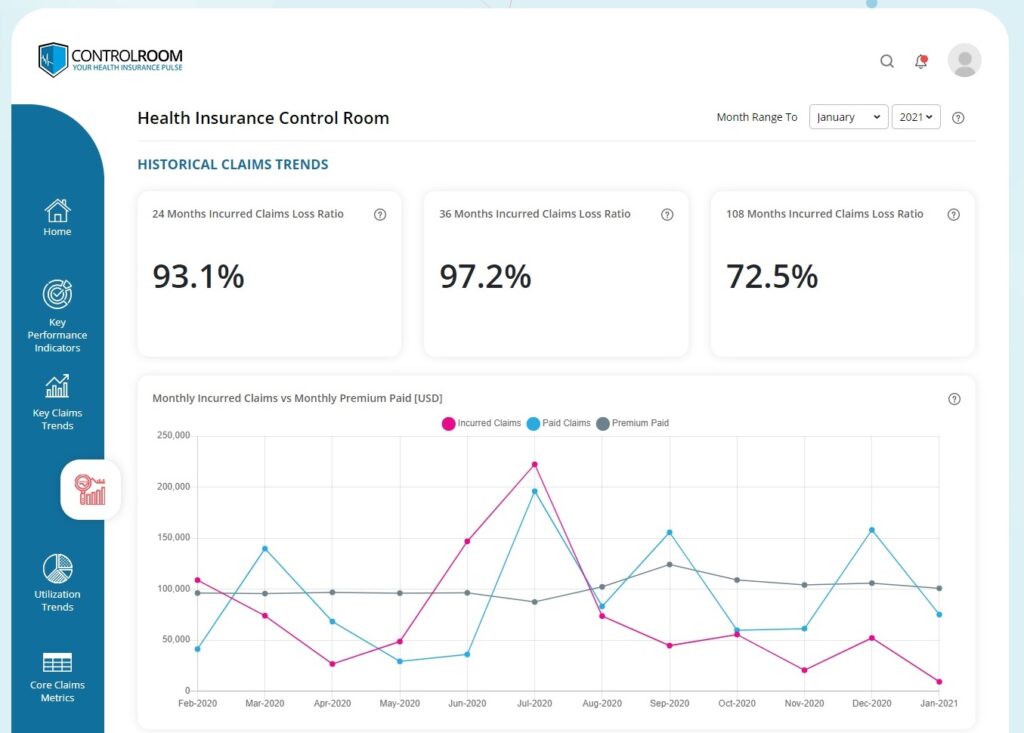

We therefore need to factor in this 4 month lag time before your loss ratio might be considered accurate and credible. If you don’t factor in this lag time, your insurance company will always say there are more claims to come. The best indicator therefore of how your health insurance plan is currently performing is to take the 12 month period that finished 4 months ago.

For example, if you are reading this article in January, you should look at your loss ratio over the period October to September. Having factored in the necessary 4 months’ lag time, the total incurred claims for this period – and corresponding loss ratio – are an excellent snapshot of the current health of your health insurance plan. You can also use legacy data to show any seasonal trends.

Do It Monthly and Save Year-on-Year

Follow this formula correctly and you get a great estimate of what you might expect renewal premiums to be at the end of your policy year. Most importantly, you can do this every month, giving you better information and amazing insight for budgeting and ammunition for negotiating the best deal when it comes time to renew.

With at least 12 months’ legacy data, you can compare the trend over time. If the numbers are trending upward, your plan’s performance is getting worse with more claims. With an upwards trend and a loss ratio of over 70%, you should prepare for a premium increase at renewal. A downward shows performance is getting better with fewer claims. Fewer claims with a loss ratio of less than 70% and you may be able to negotiate a decrease.

More Tips on How to Unlock the Power of Your Health Insurance Plan’s Claims Data

When reviewing your health insurance plan’s claims reports and claims data, some charts and data points will be richly positive but you will undoubtedly discover the occasional disturbing trend. Remember that data is neutral. Even bad news can have a positive outcome if it stops you from repeating an avoidable mistake. And continuing to monitor the situation can prevent that mistake from happening again. It all leads to a long-term outcome of better health insurance coverage for your plan’s members and the best possible return on your organization’s investment of resources of time and money.

Stay in the Know on Where They Go

You may have worked really hard to offer your employees a comprehensive health insurance plan that includes easy access to quality medical facilities through a reputable insurer. But don’t stop there. In the big picture, that’s just the beginning.

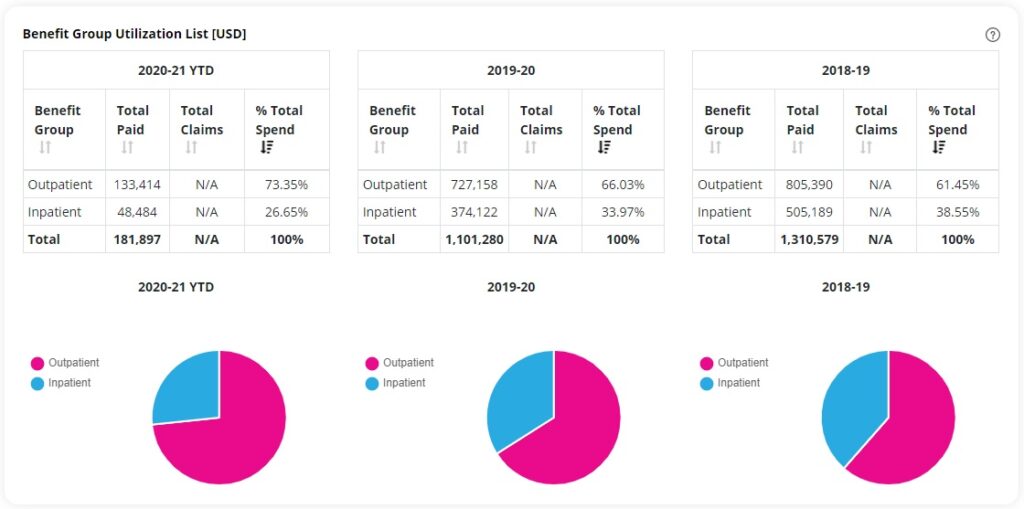

It’s wise to keep track of your members’ hospital utilization habits – which facilities they go to for what type of procedure and in which countries– and the resulting costs. In most countries, costs for similar quality care can vary wildly. Insurance companies often have a set-list of so-called “high-cost providers”, where the cost of receiving treatment is highest. Your claims data can show you if your members are going to these high-cost providers, and how often. If you are seeing a high utilization at the more expensive medical facilities, that means a higher loss ratio which can lead to sizable premium increases at renewal time. If the same quality care is available for a lower-cost, what can you do to encourage your members to look at alternatives?

Sort for Solutions

If you sort the top 10 most frequently used medical facilities by total cost of paid claims, number of claims, number of claimants and the average cost from each claim at that particular facility, a clear picture will emerge. Should you determine that too many members prefer pricey medical facilities, there are steps you can take:

- Take the time to educate your staff on the benefits to everyone of using more reasonably priced providers.

- Consult with your insurer and/or broker for guidance – they’ve surely encountered this before and may have some tried and true tricks up their sleeve.

- Plan design incentives like deductibles, provider co-pays and other measures can help affect those behaviors as well.

Timing is Everything

If you have access to 12 months or more of your data, pay attention to how much time passes between when a claim is incurred and when that claim is paid. You should notice a pattern with the majority of claims. In fact, in our experience as a health insurance broker we find that over 90% of claims are paid within 4 months of when they are incurred. If you find very low percentages of claims paid within 4 to 6 months of the claim incurred date, this might be a cause for concern and will need addressing with your insurer.

This is important ammunition at renewal time as many insurers will reference IBNR (incurred but not reported) claims as a reason for raising your premiums. Their logic is that there MUST be outstanding claims that have been incurred by your employees but that won’t be paid for the next 8-10 months so they’ll have to raise your premiums to accommodate this influx. If you have your data at your fingertips, this is the time to push back. By referencing that the lag between claims incurred and paid is a consistently shorter time period, you may show them the error of their ways and save on your premium.

The Power is At Your Fingertips

For decades group health insurance has been a black hole controlled by seemingly mysterious forces you couldn’t access or understand that absorbed increasing amounts of your budget. Having access to your data and knowing how to interpret it is changing all that. The trend towards data transparency is a pendulum swinging in your favor. So don’t miss this opportunity to take control and empower yourself.

Stay in Control of Your Renewal

Given how important the data is to help you understand the performance of your plan, why is your health insurance plan’s claims data so hard to get and sometimes even harder to understand? Although few of them will admit it, health insurance companies don’t really want you to have access to the data, much less understand it. While insurance companies are getting better at understanding the need for data transparency, the reality is that it’s better for them if their clients don’t have timely access to their plan’s claims data, so that they can stay in control of the process and renewal conversation.

At One World Cover we believe that success for our clients is achieved by shifting that control and power from the insurance company, and putting our client’s in control. It’s why we are spearheading a movement in the health insurance industry for more transparency and clarity that comes from health insurance clients not only having timely and regular access to their data, but also being able to understand and benefit from it.

To achieve the goal of empowering our client’s we have developed an online “software as a solution” (or SaaS) platform called Control Room, a health insurance claims data analysis platform, where our client’s can view and understand their health insurance data, updated monthly. If you’d like to find out more about how One World Cover’s health insurance claims data analysis platform can unlock the power in your health insurance plan’s claims data please get in touch: [email protected]

Some Final Nuggets of Gold from Your Health Insurance Plan’s Claims Data

In a perfect world your health insurer or broker would sit down regularly with folks from your HR and finance departments to review the latest claims data from your employee health insurance plan. HR could learn about healthcare provider utilization trends and wellness programs with advice on how plan adjustments and messaging can have an impact. Finance could get the lowdown on claims versus premiums and get a better understanding on how things like “claims lag” might impact your claims loss ratio and lead to a premium increase.

In reality, most see their claims data only once at policy renewal time or not at all. And if they do get the data or reporting, it’s difficult to understand and rarely explained. So when the insurer says premiums need to go up, you just have to trust them. But how would insurers react if you said premiums need to go down for reasons you didn’t explain and asked them to trust you?

One solution lies in making sure you have access to claims reports in a timely manner and expending the effort to dig below the surface.

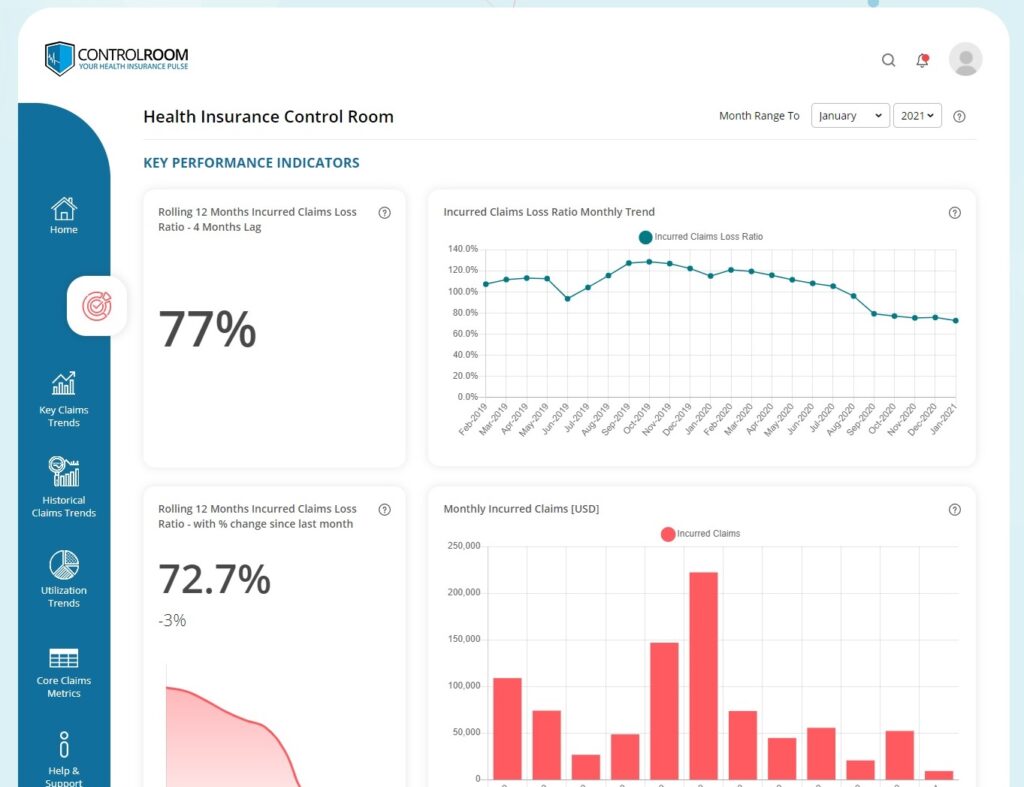

A fairly simple number to track is the average claim cost per member (or “life”). Just divide the total in claims incurred to date by the number of lives covered on your plan. This yields the average amount a single person on your plan has claimed for reimbursement. Now divide the number of lives covered by the premiums paid to date and you get the average amount you’re paying to cover each life.

In a healthy plan the second number should be lower than the first. If people are claiming more than you are paying for the plan, this can lead to trouble like higher loss ratios and steep premium hikes at renewal time. So, if you have frequent, instant access to your data, it makes sense to check these numbers throughout your policy year to avoid negative trends that could lead to nasty surprises.

Looking Backward for Insight to Plan Forward

If you can get your hands on at least three years of past data, do the average claims cost calculation for each previous policy year and look for trends. Is the number growing? Can you see any correlation between this number and premiums increasing, staying the same or decreasing? And also have a look how these numbers relate to medical inflation, which is usually 6-12% depending on the country.

While there are some things you can do about medical inflation within your organization, it’s generally regarded as outside your realm of influence and often cited by insurers as a major cause for increasing premiums. But if your average claim cost per life over multiple years shows yours has been decreasing over time at a rate equal to or faster than medical inflation has been increasing, you can push back on any medical inflation related premium hikes your insurer proposes.

Making Sense of the “Per Cents”

Another piece of information to investigate is the percentage of lives claiming year to date. In plain language, this is the portion of your plan members who have incurred claims so far in your current policy year.

A large percentage is good but too high is bad, as more claims incurred means more premiums spent on paying them. This leads to a high loss ratio and probable premium hikes. But too few is also a negative trend. This could show a communications issue as perhaps plan members are not aware of all the benefits or, worse yet, that your plan does not adequately cover their needs.

If you have the depth of information, compare it to earlier years’ data for reference. Both cases can benefit from clear outgoing communication, good listening skills and keeping a close eye on the numbers.

How the Numbers Add Up for You

It all comes down to the fact that health insurance is an extremely data driven industry. Your insurance company will try to use your data – and your lack of understanding of the data and underlying trends – against you at renewal each year to justify increases in premiums. Turn the conversation around and use your data to your advantage. Get yourself in the position of control.

We hope you can see from this three-part series how important it is to have regular access to your health insurance plan’s claims data and how understanding the data can be an extremely powerful tool for driving improvements and understanding any issues relating to cost, quality and outcomes.

To achieve the goal of empowering our client’s we have developed an online “software as a solution” (or SaaS) platform called Control Room, a health insurance claims data analysis platform, where our client’s can view and understand their health insurance data, updated monthly. If you’d like to find out more about how One World Cover’s health insurance claims data analysis platform can unlock the power in your health insurance plan’s claims data please get in touch: [email protected]