You don’t have to be an insurance expert to lower premiums at renewal time

Every year health insurance premiums increase.

Many companies and organizations are receiving their January 1 group employee health insurance renewal rates now.

And for many finance and HR departments, it is not pretty.

Why?

Soaring post-covid healthcare costs and increased healthcare utilization are contributing to the highest projected increases in worldwide medical costs in more than 10 years.

The knock on effect is that your company’s group health insurance premiums are also rising, and the year-on-year premium increases are becoming unsustainable for any finance department.

What can you do?

If you’re an international organization employing a large number of expats living abroad, group health insurance is one of the high cost items on your budget list – typically it is in your top five expenditures.

Companies everywhere are taking a hard look at budgets with an eye on slashing costs on everything.

Unless you’re an insurance expert, you may not understand why or think there’s anything you can do about it.

You could change insurers but the last thing you need with all your current responsibilities is more on your plate. Of course, the easy way to cut costs would be to strip your plan benefits to the bare minimum.

But in a time when healthcare worries are on everybody’s mind, doing so would risk a mutiny from your employees.

Fear not. Here are 3 Steps to drastically reduce your group health Insurance premiums without changing insurer.

It’s how we help our many of our clients lower their health insurance premiums without gutting their plan or switching insurance providers.

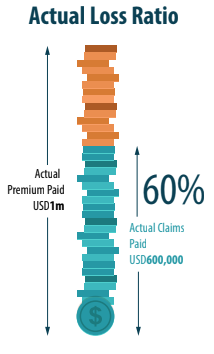

Step 1: Understand Your Actual Loss Ratio

This is the most important number your health insurer uses to calculate premiums at renewal time. Simply stated, it’s the total amount you’ve paid divided by the total amount of claims. Roughly 25% of your premiums are used to cover the insurer’s operating expenses and fees. The remaining 75% is used to pay claims.

If your loss ratio is less than 75%, you might not be facing a valid rate hike. If it’s substantially less than that, you could even be in a position to negotiate a refund or reduction. But you need to make sure you’re looking at the actual loss ratio. Some insurers and brokers will try to skew the data to make the loss ratio appear higher than it actually is. This could be the easiest win of this whole 3-step process and you can learn more here.

Step 2: Examine Your Plan’s Benefits Utilization

Take a good long look at how your employees use your plan. A careful, in-depth analysis of your claims experience, usage and trends is critical.

Divide your existing benefits into the “must haves” and the “nice to haves” and align them with their corresponding costs.

Then consider what adjustments you might make to benefits that lower costs overall.

- Are your expat employees delaying their elective procedures in favor of attending to them in countries with higher healthcare costs – like the United States?

- Are high-cost benefits (like wellness, dental, and unlimited out-patient coverage) under-utilized?

- Are your plan members favoring more expensive medical facilities in-country over less expensive care providers of equal quality?

Knowing the real cost to you, the value to your employees and the utilization data for each aspect of your plan will give you a much clearer picture of how you might be able to adjust your plan’s benefits.

It’s possible to save money while showing sensitivity to your employees by only making changes that won’t impact how the majority actually use the plan. It’s another easy win.

Step 3: Roll Up Your Sleeves and Start Tinkering

Once you know your loss ratio and utilisation, you can start tweaking the plan.

Remember, this is a delicate process and the satisfaction of your employees hangs in the balance. Here are some suggested remedies:

Area of Coverage:

Limiting the coverage outside of the country where your employees reside can save considerable funds. You can still allow for safe vacation travel by supplementing the medical insurance plan with travel insurance that covers business trips outside the core area of coverage – such as trips to the US.

Annual Deductible:

Adding an annual deductible to your plan is a great way to bring down the premiums and pass on some of the cost to the employees. It also influences how your members will use the plan. The higher the deductible, the lower your plan’s premiums.

Policy Co-Pay:

A policy co-pay asks members to pay a percentage of out-patient treatment costs, in-patient costs, or both. For example, a 20% co-pay means the member will contribute 20% of the treatment costs at any treatment facility.

The higher the co-pay, the lower your plan’s premiums.

Provider Co-Pay:

A provider co-pay only applies to a set list of high-cost provider (HCP’s) treatment facilities only. For example, a 20% co-pay means the member will contribute 20% of the treatment costs at high cost providers only.

This will encourage members to use healthcare providers of equal quality but lower cost.

Out-of-Pocket Maximum:

It’s possible to put a cap on the total out-of-pocket expense to limit each members financial risk exposure. This is known as an “out-of-pocket” maximum (or OOP Max). An OOP Max is usually combined with a co-pay plan, where the member is responsible for 20% of the treatment costs.

For example, a $3,000 OOP Max with a 20% co-pay means the member will contribute 20% of the treatment costs up to $3,000. The members risk is capped at $3,000, making them price conscious when selecting their treatment facility, but not financially bankrupt due to a high catastrophic claim.

The higher the OOP Max, the lower your plan’s premiums.

Out-Patient Limit:

Out-patient treatment is a highly-used benefit and any change here can have a powerful impact on lowering your plan’s overall cost.

It’s important that the limit only apply to out-patient benefits such as visits to a family doctor and prescription medication, and not to out-patient surgery and out-patient cancer treatment. The lower your plan’s out-patient limit, the lower your plan’s premiums.

What’s the right combination?

The best running programs include:

- an annual deductible (Usd500 as a minimum),

- a 20% Policy Co-Pay, and

- an Out-of-Pocket Maximum (Usd3,000 as a minimum)

Combine these three adjustments, and your company will save significantly on the premiums year one, and every year thereafter, whilst ensuring the integrity of a great health insurance program for staff.

Show You Care Through Clear Communication

Keep in mind that changes in your company’s health insurance plan design can be met with disdain, scepticism and even anger.

As long as your company is not removing the key hospitalisation benefits, your members will still have great health insurance and this is the key message you should drive within your organisation.

The key is to manage the message to the expectations through informed, clear communication, backed up by experience, knowledge and an explanation of why changes have come about.

It’s OK to Ask For Help

If these suggestions seem complex and the thought of facing your employees with plan changes on your own is daunting, consider reaching out to an experienced, qualified broker or consultant for help.

One World Cover consistently helps our clients reduce their group health insurance premiums by between 15-30%, without having to make any plan design changes or change insurance providers.