In China, the retention of key staff is extremely difficult – headhunting agencies and competitors are always seeking out the best people in the market, and employees often ‘jump ship’ for only a small increase in salary. Consequently, China-based companies are continuously on the lookout for creative ways to build employee retention programs that help keep their key people – whether local Chinese staff or expats – for the long-term.

A well-designed group pension plan can help incentivise key staff to stay with a business for the long-term, with the employer contributing to a long-term pension fund in the name of the employee. What makes this employee benefit most interesting is that the employer can design the pension scheme structure so as to only benefit employees who remain loyal to the business, by setting vesting structures or rules (vesting refers to the employee portion of ownership in the pension fund) which gradually ‘commit’ the pension fund to the employee after completing an agreed set term. If the employee leaves the business early, they will essentially be forfeiting a percentage of their pension which is then refunded to the business, along with any interest earned.

There are many companies in the China insurance market offering pension plans – almost all large Chinese insurers have an annuity division that handles such products.

Most insurance companies (or pension providers) also provide an online portal for both:

- the administrators of the group plan (HR, CFO, etc), giving access to the details needed to administer the plan; and,

- the end users (the employee), to check performance and manage the pension (where/if options are given)

In speaking with our clients and potential clients we have found that there are a number of key areas that administrators and employees do not understand or would like more information on when it comes to China-based group pension plans. We have therefore put together the key questions we hear into the below simple Q&A. (Please note that the answers and feedback noted below are from one international brand China-based pension provider only and therefore do not necessarily reflect the business operations of all pension providers).

While – as noted above – there are many companies in the China insurance market offering pension plans, the below Q&A is primarily aimed at foreign companies in China who are interested in setting up a group pension plan for their expat employees. There is obviously a great deal of information on China-based group pension plans in Chinese, but we have found there is limited information available on China-based group pension plans in English and as a result many foreign companies look at ‘offshore’ (outside China) options but then run into other compliance issues, such as not being able to get a fapiao for the payment (yes, a fapiao is available for the option outlined below), remittance of funds abroad issues, and local individual income tax compliance issues.

As a side note, please note that if you are wondering if China-based pension providers have access to international funds or investment opportunities, according to our understanding the investment portfolios are primarily China-based, but a small percentage is put into overseas market through QDII.

If a group is to purchase a plan and contribute a certain amount into the pension fund, such as 8% of salary, can the employee also choose to contribute further amounts? Such as an extra 2% or 3%, for example?”

Yes, the employee can choose to contribute as well. The amount can be decided by the employer.

Yes, the employee can choose their percentage individually. It is also possible to set several choices for them, for example: option A) 2%, option B) 3%, option C) 4%, etc.

If the employee can choose individually, must it be the same contribution every month, or can they change every month?

It is not suggested to change the contribution percentage monthly, as it will cause a lot of admin work for HR. However, the employee can be given the option to change the contribution ratio once annually, by completing the necessary forms and submitting to HR before a specified date.

If a group is to create a pension fund and contribute a set amount such as 5% of salary each month, can the group offer to match any contribution an employee also chooses to contribute? For example, if the employee wants to contribute 3%, the group would contribute 5% plus 3% = 8%?

Yes, this is possible, and will also have the additional benefit of encouraging the employee to contribute.

When does an employee get access to their pension fund? Is it only after they retire? Or is it when they leave the company?

This is decided by the employer when setting up the pension program and vesting rules.

Generally speaking, the employer will set up a vesting rule which will enable employees to have access to their fund after several participating years in the plan or several years working in the company – hence the attractiveness of such pension schemes as an employee retention strategy.

For expat employees working in a Chinese company that contributes to a pension scheme can their pension funds be paid out to other countries at resignation/retirement?

No. This was possible in the past, however, according to new local laws, the remittance of pension funds abroad is forbidden by the regulation issued by SAFE.

How can an expat employee leaving China extract his/her pension fund when leaving China?

He/she can apply to the pension fund provider for payout, which will be paid to their China bank account. Once received, the expat employee will need to provide the relevant tax documentation to their Chinese bank to remit the money outside China. Each expat employee can access their tax records via the government tax portal: https://gr.tax.sh.gov.cn/portals/web/login. Please note that the website is only in Chinese.

Can a member continue to contribute to the group pension plan after leaving the company?

No. Since the group pension plan is paid by the company, employees can no longer contribute when they are no longer members of the company.

For any funds which are not forwarded to the member due to the vesting period not being met (known as ‘unvested funds’), how are the funds reimbursed (or accumulated) to the company?

The unvested fund will go to the employer’s public pool account, which can be used to offset future contributions or be refunded to the company.

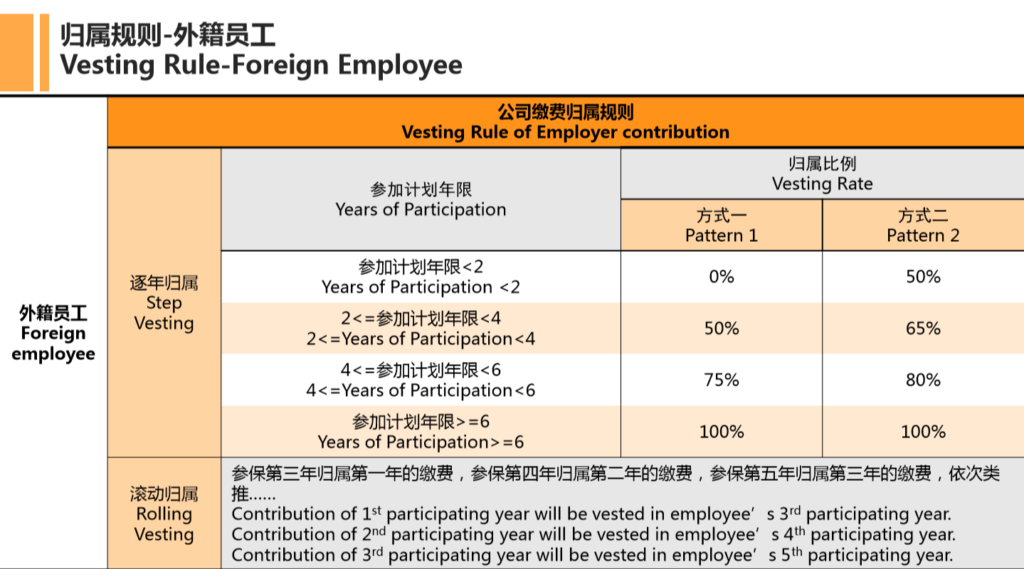

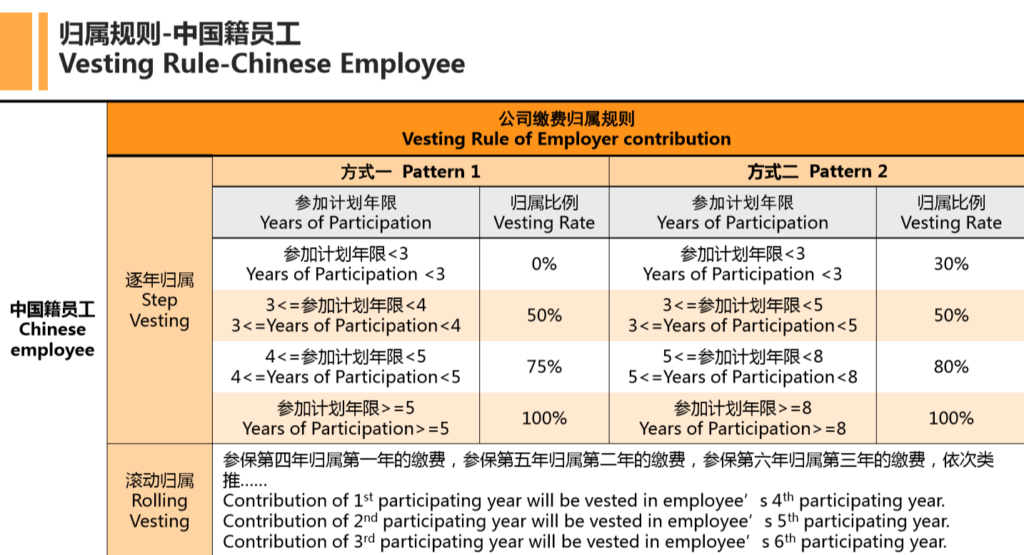

When a company sets up a pension plan, they can choose the vesting structure or rules, such as one geared towards employee retention. Below are two examples of how the employer may look to vest to encourage key staff to remain in the business:

Examples 1: Funds vested to employee beginning after two years of working in the company, to encourage retention of employees who are not expected to remain in the business for more than 5-6 years, such as expat employees:

Examples 2: A longer-term plan, with a gradual increase of contributions vested to employees for each year of service:

Companies can choose the fund the pension is paid into, such as guaranteed return, or allow the members to choose the fund – which may have more risk / higher returns. Employees will love the fact that they can actively engage in how the fund is invested.

If an employee leaves the company, must they then withdraw their pension fund immediately leaving the company?

They can choose to withdraw or set-up a reserve account. The reserve account can be withdrawn in future upon application of the employee.

If owing to the vesting rules in place an employee is only entitled to withdraw 30% when they leave the company (see above examples), what happens to the remaining 70%?

The remaining 70% will go to the employers’ public pool account, which can be used to offset the future contribution or can be withdrawn by the business.

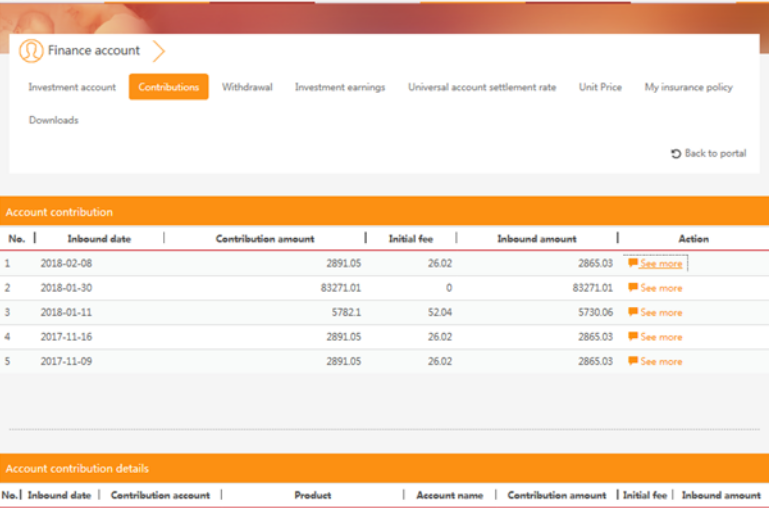

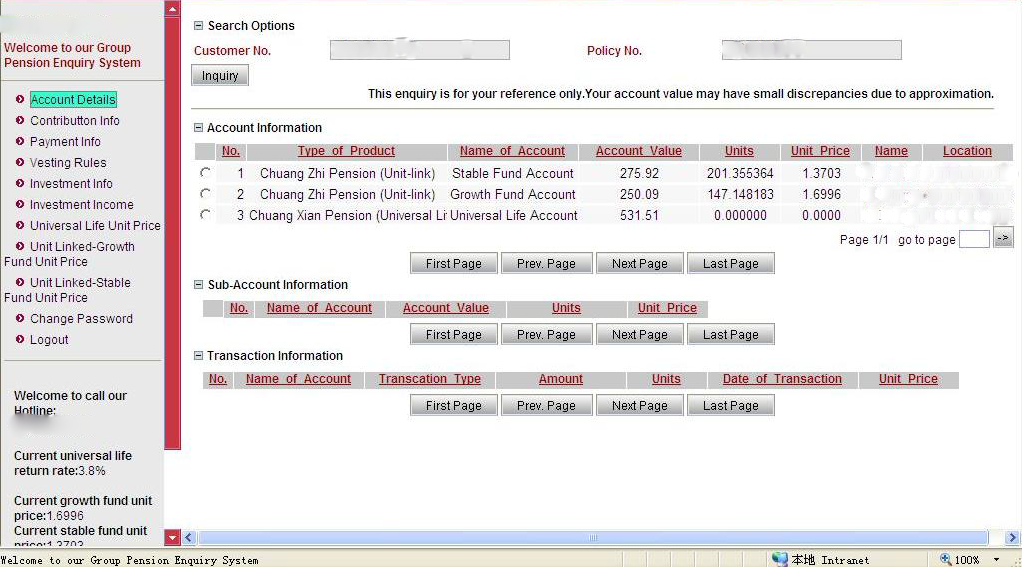

English-language online portals for expat employees.

Currently, we are only aware of two pension providers who have web portals geared towards businesses with expat employees, with English language portals.

The employee can set their own personal login password with their mobile phone number or email address, and review the pension fund performance when they wish.

There is also a separate portal for administrators.

Why not just open a saving account?”

A number of employers have asked what interest rate return they would get if they simply paid the money into a savings account for the employee. What is an expected interest rate with a local Chinese bank? And does a pension fund have better returns across, for example, a two year and five year period?

For China-based savings accounts, the 1-year time deposit base interest rate is 1.5% – though certain commercial banks offer 2.1%. The 2-year time deposit base interest rate is 2.1% – though certain commercial banks offer 2.7%.

A pension fund has a guaranteed interest rate of 2.5% and the actual interest rate is around 4%. The return will be similar to a bank savings account over a short period such as one or two years, however over longer periods such as three or more years, it is expected that a pension will outperform a savings account. Important note: A pension fund scheme might have a better return across a two year period.

One China-based pension provider had their stable account (lower risk) unit price increase by 6.85% between 2015 and 2018, and 7.73% for their growth account (higher risk), but there also exists risk of investment loss.

How much does it cost (fund and fees)?

The cost of a pension fund is made up of two parts:

- The pension fund committed/vested to the employee. For example, the group may commit 8% of an employee’s monthly salary.

- There is an initial admin fee of 3% of each sum of fund remitted to the pension provider. This can be negotiated slightly lower if the annual contribution volumes are very high (for large groups only).

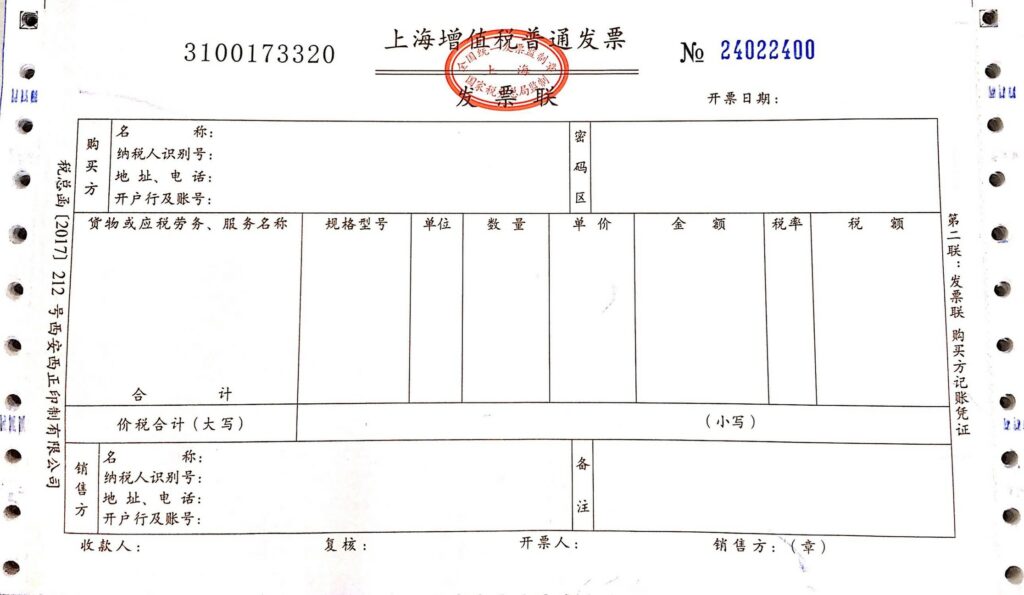

When a client pays the premium to the pension provider, will a fapiao (official Chinese tax invoice) be provided?

Yes, please see the below example:

Is individual income tax (IIT) payable on the premium paid to the pension insurer?

Yes. According to local regulation IIT is payable on the pension premium, and then the remaining amount is paid to the pension fund. There is also an option to pay taxes at a later date, though the process is more complicated and tax is also paid on any interest earnings.

Are there any ‘tax discounts’ available for on the IIT collected?

The pension is subject to IIT, so in theory, no.

Are there any further business or additional individual taxes to be paid on the money that is paid into the pension fund?

No.

Are there any further business or additional individual taxes to be paid when the employee collects their pension fund at retirement or when leaving the company?

No. As IIT has already been paid there are no further taxes to be paid, either on the fund itself or on the interests or gains.

Important note: all details should be checked and confirmed with your company’s finance and tax division and/or an employee’s personal tax advisor.

Disclaimer: This is not financial advice, nor tax advice.